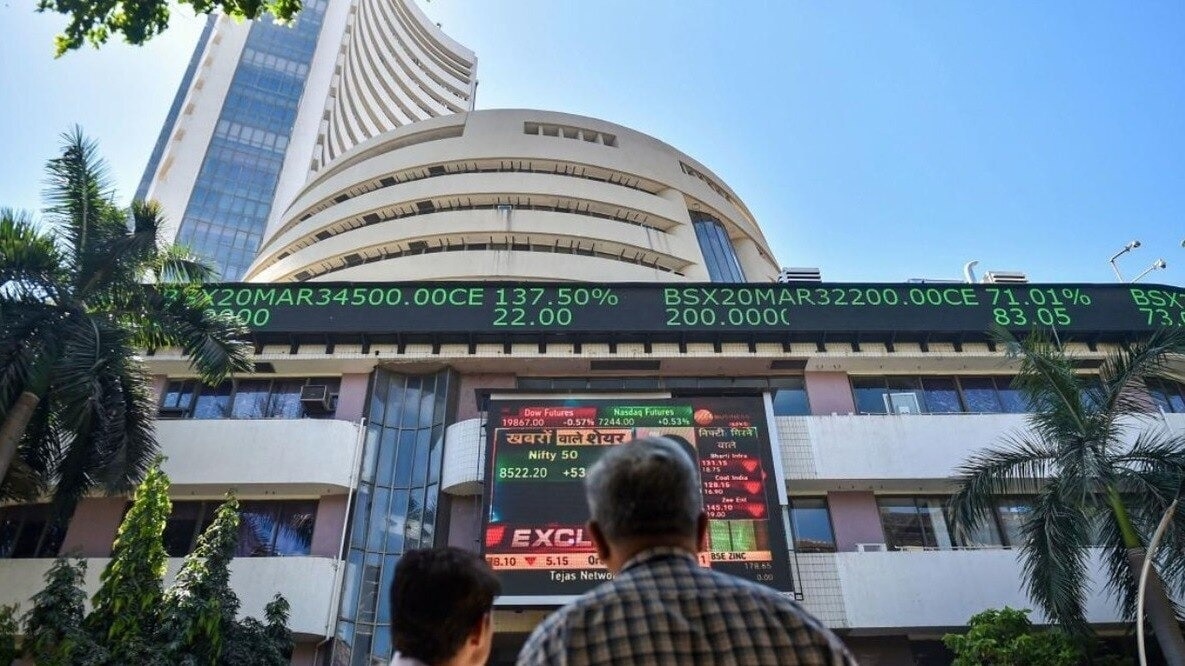

Sensex crashes 1,300 points as Trump 2.0 spooks investors. 3 things to know

A volatile session on Dalal Street turned into a nightmare for stock market investors as the benchmark indices crashed after swinging between gains and losses for most of the session.

The Sensex tumbled 1,300 points to 75,773 at around 2:45 pm, while the Nifty50 fell below 23,000. All other broader market indices also collapsed during the trading session.

The main reason behind the stock market crash was uncertainty over US President Donald Trump's tariff plan after he returned to the White House for his second term.

Here are all the factors that led to today's bloodbath on Dalal Street:

TRUMP TARIFF UNCERTAINTY

As mentioned earlier, the uncertainty over Donald Trump's tariff plan triggered panic among investors. In an earlier article, we explained how the unprdictability of tariff plans has led to higher volatility on Dalal Street.

HEAVYWEIGHT STOCKS DECLINE

Major stocks across several sectors fell sharply during the trading session, leading to today's downturn. Zomato was on course to register an 11% decline and was the top loser on the Bombay Stock Exchange (BSE). Other heavyweight stocks such as ICICI Bank, HDFC Bank, Reliance and SBI also tumbled sharply during the session, leading to the stock market slump.

Q3 RESULTS FAILS TO IMPRESS

A majority of companies that have reported their Q3 results have either failed to meet expectations or barely scraped through. Only a handful of companies have managed to defy expectations. And a Bloomberg consensus estimate has indicated that the earnings per share (EPS) of Nifty50 companies may grow by just 3% year-on-year in the third quarter. Only the capital goods, healthcare and telecom sectors are likely to register double-digit profit growth.

VOLATILITY SKYROCKETS

Volatility also spiked during the session due to the prevailing sentiments among Dalal Street investors. Investors remain worried about the impact of Trump's delayed tariff announcements, which could lead to a prolonged period of uncertainty for them.

Had Trump executed his tariff plans, it could have provided clarity to investors on which sectors will be hit. However, experts said that the ambiguity surrounding Trump's tariff plan will force investors to "wait and watch" for a longer period and this could lead to a longer period of volatility on Dalal Street.

FII SELLING CONTINUES

The above factors have just made the situation worse on Dalal Street, given that it is already facing an exodus of foreign institutional investors (FIIs). As of January 20, FIIs have pulled out equity holdings worth over Rs 48,000 crore. In an uncertain market, FII selling could intensify and hit domestic stock market investors harder.

(Disclaimer: The views, opinions, recommendations, and suggestions expressed by experts/brokerages in this article are their own and do not reflect the views of the India Today Group. It is advisable to consult a qualified broker or financial advisor before making any actual investment or trading choices.)